Download Form 26as Traces

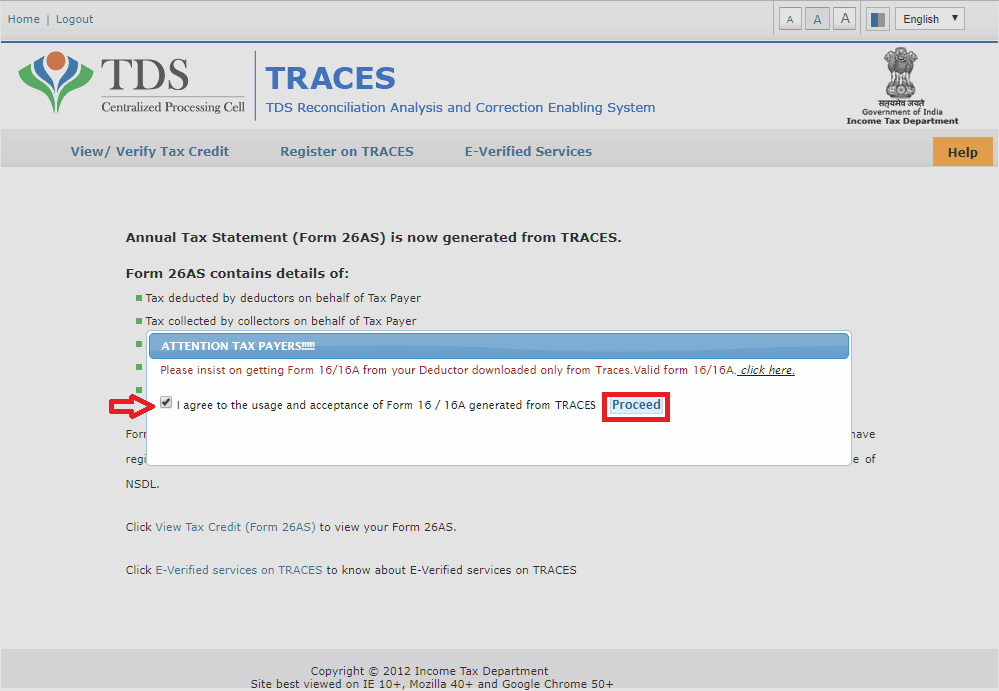

- Here are the simple steps to download Form 26AS. Click on ‘Confirm’ and this will take you to the TRACES website. Once you are on the TRACES (TDS-CPC) website, select the box on the screen.

- View Form 26AS (details of Tax payment and TDS available with Department) To view Form 26AS, please follow the below steps: Login to e-Filing website with User ID, Password, Date of Birth /Date of Incorporation and Captcha.

- Step by Step guide with screenshots on how to view Form 26AS and download it through the TRACES website or via Net banking.

- TRACES site is the worst government site that I've ever seen. First registering on this site was a pain. Now its been a week and it still shows my request for form 26AS as 'submitted'. Do not even provides a clue when it'll be avaialble for download. Reply Delete.

- If you want to download this form in Excel format you need to login via TRACES account. As of now PDF is not asking for any password. However, as per TRACES website password for 26AS PDF/text file is Date of Birth / Date of Incorporation in ddmmyy format as printed on PAN card.

- Form 26as Download Online Traces

- How To Download Form 26as From Traces Login

- How To Download Form 26as From Traces Without Registration

- 26as

- View Form 26as From Traces

Know how to view and download Form 26AS from traces website. When it is available, Importance, Usage & Step by step process to download Form 26AS.

26AS is basically a yearly credit summary provided by the Income-tax department. It gives all the taxpayer’s details of the tax credit on the basis of their PAN. The amount of TDS deducted will be reflected and available for adjusting against Income tax liability. There are five parts in 26AS. The taxpayer can use net banking login to view his 26AS.

26AS is basically an annual credit summary given by the Income-tax department. It gives us details of the tax credit for each taxpayer on the basis of his PAN. It reflects the amount of TDS deducted and available for adjustment against your Income tax payable(liability).

Below you’ll find some of the services provided at Vakilsearch that may answer your on the procedure, documents and process flow for a government or tax registration.

| Register a Company | PF Registration | MSME Registration |

| Income Tax Return | FSSAI registration | Trademark Registration |

| ESI Registration | ISO certification | Patent Filing in india |

Form 26as Download Online Traces

What Does It Contain?

Like the 5 heads of income, 26AS also has 5 parts, the following are;

Mac iphoto download. The biggest reason why this issue occurs is.Can't Miss: Quick Fixes to iPhone Doesn’t Show Up in iPhotoIn this post, we will show you some potential fixes to solve the iPhoto not recognizing iPhone issue. And if that doesn't help, restart your Mac and your iPhone. Quit iPhoto and re-launch it.

Get the song on his latest album, THE ELEMENTS. Get the song on the album here: Subscribe to TobyMac videos on YouTube: https://tobymac.lnk.to/subs. Tobymac all songs.

- Part A & Part A1 – Details of tax deducted by the deductor. Eg- From the employer, contractor, bank, tenant.

- Part B – Details of tax collected at source against your PAN.

- Part C– Details of any other tax paid by you Eg – Advance tax, Self-Assessment tax, regular assessment tax.

- Part D – Details of the refund received along with interest on the refund.

- Part E – Details of annual information return (AIR). AIR is filled with information received from different entities when you enter into any high-value transaction. Eg shares, mutual fund, and other investments.

How To View 26AS?

Each taxpayer can view his 26AS through his net banking login. Traces supports almost all major and nationalized banking channels

Another way to view your 26AS without registering with traces- TDS reconciliation analysis and correction enabling system will be through your income tax registration

How To Download Form 26as From Traces Login

- Login to your income tax portal

- From above tabs click my account

- View from 26AS

- Click on confirm

- After checking the box click proceed

- Click on “ view form 26AS”

- Select the assessment year (FY 18-19 has an AY of 19-20) and the required format for download

- Fill the captcha and proceed to download

How Will It Help While Filing Your IT Return?

One should effectively cross check if the figures reflected in his TDS certificate given by his deductor (employer, bank) is also reflected in his 26AS. Form 16/16A must be reconciled and matched with form 26AS

It helps you to easily identify defects relating to all the deductions made using your PAN. You can claim other taxes paid by you, you can also verify the refund received along with interest on the same. Thus it enables easy processing of your Income tax return.

TDS is entirely based on PAN so a taxpayer should verify if the name, PAN, TAN of deductor, deductor, AY/FY are to his corresponding. Assessee must provide his PAN, else he will be charged at a higher rate – now prevailing at 20%.

What Should I Do If There’s An Error In My 26as?

It is mostly due to PAN being incorrectly entered instead of yours. Another reason for the mistake might be because the deductor might have deducted but the same has not been paid to the government.

In that case, it will be your responsibility to follow up your deductor and ask him to rectify the discrepancies. To be precise, communicate in case of errors too;

How To Download Form 26as From Traces Without Registration

- Part A & Part A1 – Deductor of taxes

- Part B – Collector of taxes

- Part C- Assessing officer/bank

- Part D- Assessing officer/ITR-CPC

- Part E- Concerned AIR filer

26as

The figures reflecting in his TDS certificate produced by the deductor should be cross checked with his 26AS. The form 16/16A should be matched and reconciled with 26AS form. The form helps to identify the defects related to the deductions that are made with your PAN. 26AS helps for easy processing of your Income tax return.